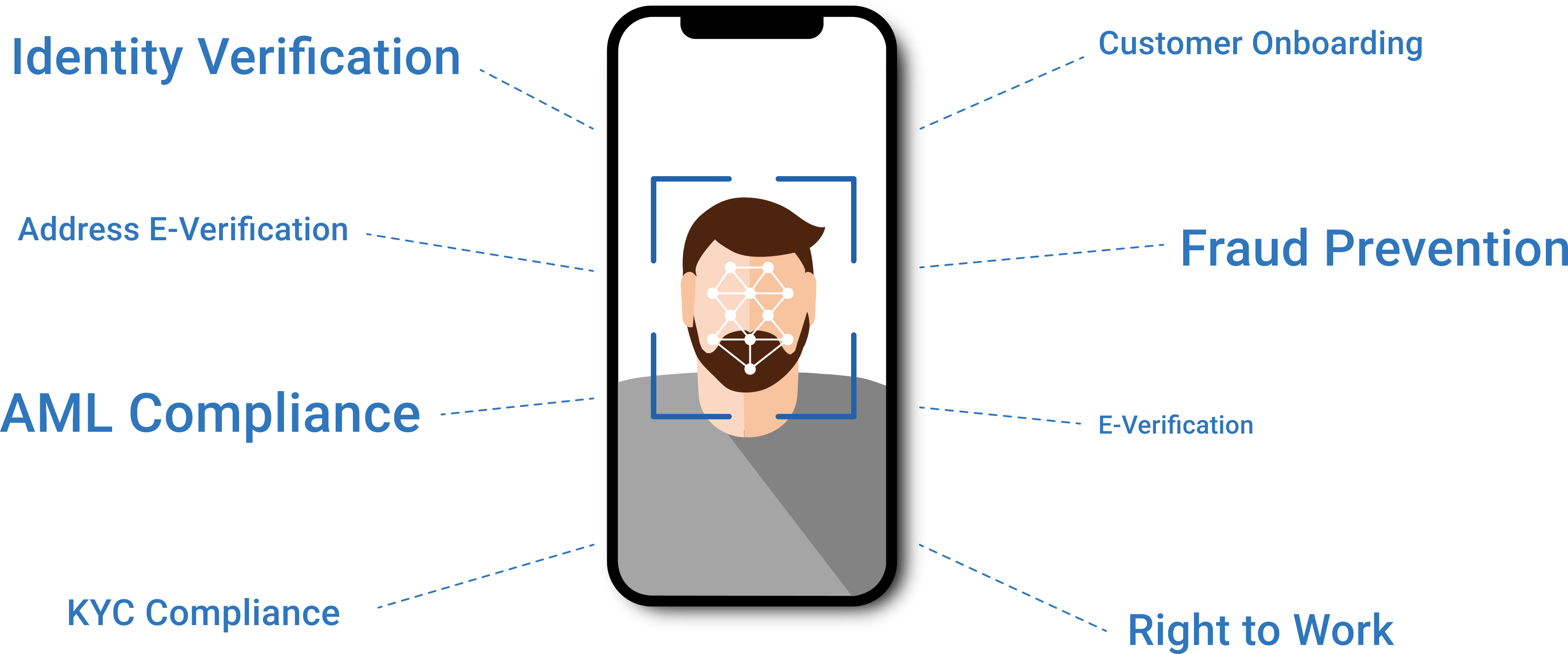

ID-Pal provides an award-winning Identity Verification experience for any business case. From growing your business through customer onboarding, to meeting AML/KYC compliance requirements and protecting your business from fraud. Whatever you need Identity Verification for, we can help.

How Can ID-Pal Help Your Business?

Digital Identity Verification & Online ID Verification

ID-Pal’s fully customisable solution is the easiest way to verify identities in real-time, simply, securely and conveniently.

Identity Document Validation Solution

A suite of rigorous technical checks determines if the identity document is genuine and has not been tampered with or forged.

Identity Document Verification

A suite of rigorous technical checks determines if the identity document is genuine and has not been tampered with or forged.

Address E-Verification

Strengthens fraud protection for businesses while simplifying the process for customers.

AML Compliance

Meet your Anti-Money Laundering compliance requirements with an Identity Verification solution that has AML compliance built in.

PEPs and Sanctions

Seamlessly integrate PEPs and Sanctions screening into your identity verification process while minimising false positives.

KYC Compliance

Meet your KYC compliance requirements and protect your business from fraud with ID-Pal’s KYC compliance solution.

Customer Onboarding

Simplify the customer onboarding process using ID-Pal’s remote, digital identity verification solution.

Fraud Prevention

Protect your business from fraud with the Identity Verification service that won Merchant Anti-Fraud Solution of the Year.

Right to Work

Enabling businesses of any size to meet their Right to Work checks simply, securely and conveniently.

Right to Rent

A certified IDSP that provides the easiest way to conduct digital Right to Rent (RTR) checks.

Our experience of working with the team in ID-Pal was 100% positive. ID-Pal were professional, open-minded, and available to talk to me whenever needed. Our ask was very clear, in that we required a more efficient, effective, and secure KYC process, supported by a client-friendly cloud-based application. ID-Pal has proven itself to be an agile, yet fully compliant partner, evidenced by BDO Ireland's seamless adoption across all departments.