Streamline KYC compliance into a simple connected flow to seamlessly verify identities in real-time.

KYC is the process of obtaining information about a customer and verifying their identity. ID-Pal performs real-time identity verification online, in-person or remotely via an award-winning app, with exceptional accuracy and zero access to customer data.

Streamline identity verification for KYC compliance and customer onboarding in just one day.

With a user-friendly interface and seamless integration options, our ID verification solutions transform KYC compliance and enhance the onboarding experience.

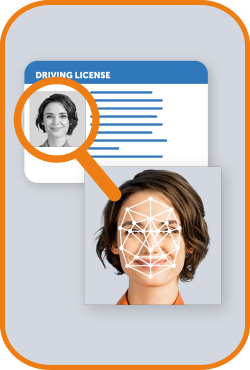

ID-Pal performs up to 70 technical checks per document, to ensure authenticity and confidently reject suspicious submissions. Our multi-layered identity verification process then verifies the facial image present.

Unburden your team from the challenge of manual identity verification. Our cutting-edge facial matching technology instantly confirms that the face in a submitted ID matches the person present. A 50-point biometric facial comparison maps features as part of our identity verification process.

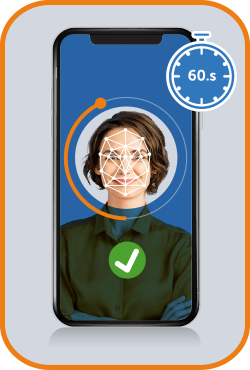

Liveness Checks confirm a real, live person is completing your identity verification process. ID-Pal Liveness Testing instantly assesses micro-variations in fraudulent techniques. This is why our Liveness Testing technology is independently certified to prevent the latest presentation attacks.

Reduce customer onboarding times with Address E-Verification. ID-Pal verifies an individual’s Name and Address against multiple databases during onboarding, ensuring one clear Full Address Match & removing the need for Proof of Address.

Add an additional layer of fraud prevention to your plan. Screen individuals in real-time against global PEPs and Sanctions lists. Perform adverse media checks across live sources and easily enroll individuals for periodic risk screening and ongoing monitoring.

Add-On Feature (additional cost)

Our platform is fully encrypted and has zero access to customer data. ISO 9001 and ISO 27001 certified, ID-Pal maintains the highest security standards.

Covering 7000+ Identity Documents from across 200+ jurisdictions, enjoy enhanced verification using 160+ trusted data sources.

Using advanced matching algorithms, gain back resources diverted to address false-positive rates.

Choose from our range of easy integration options. Deploy same-day or via our API/SDK

Learn how our customers prevent fraud and simplify compliance

Have more questions? We’re here to help! Get in touch to find out more about our Identity Verification solutions.

KYC Compliance is a regulatory standard mandating financial institutions to verify the identity of their clients to prevent financial crimes like money laundering and fraud. Identity verification plays a crucial role in KYC processes by ensuring that the institution knows the true identity of its customers, thus mitigating potential risks of illegal activities.

By conducting thorough identity checks, including document verification and biometric analysis, institutions can adhere to regulatory requirements, reduce the risk of penalties, and maintain secure business operations.

Identity verification in KYC compliance involves several steps to ensure a customer’s identity matches their provided documents. This typically includes:

Digital identity verification offers several key benefits for KYC compliance, enhancing both operational efficiency and regulatory adherence. By automating the verification process, you’re allowing for quick customer onboarding without compromising on accuracy.

These systems reduce human error and increase reliability through advanced algorithms and machine learning, making them cost-effective by decreasing operational costs associated with manual verification processes.

Furthermore, automated systems ensure adherence to evolving regulatory requirements with up-to-date checks and documentation capabilities. The quick and seamless verification process also improves customer experience, increasing satisfaction and loyalty.

USA

Ireland

United Kingdom

USA

USA

Ireland

UK

USA

Copyright © 2025 ID-Pal. All rights reserved.