The more verification layers present, the harder it is for fraudsters to win. Most importantly, the user journey is easy and friction-free.

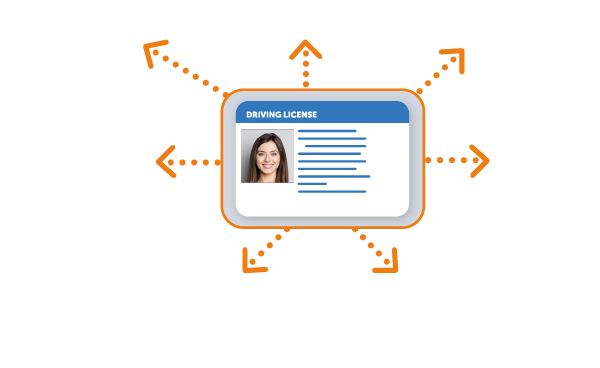

Verify the details submitted by an individual match their residential address. Gain confidence in the identity of your clients, members or customers.

Capture, verify and securely store data from any point of onboarding to align offline and digital channels. Simplify results with one clear, full Address Match.

Enjoy a prebuilt solution that easily integrates into your existing workflow, eliminating the need for costly transformation projects or piecing together the isolated blocks of typical solutions.

With ID-Pal, achieve robust compliance and operational efficiency in one day, ensuring a lower total cost of ownership while safeguarding your practice against financial crimes.

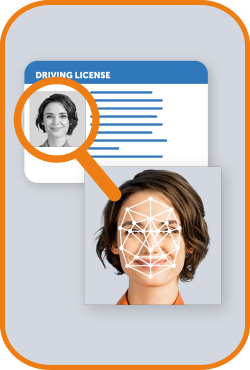

ID-Pal performs up to 70 technical checks per document, to ensure authenticity and confidently reject suspicious submissions. Our multi-layered identity verification process then verifies the facial image present.

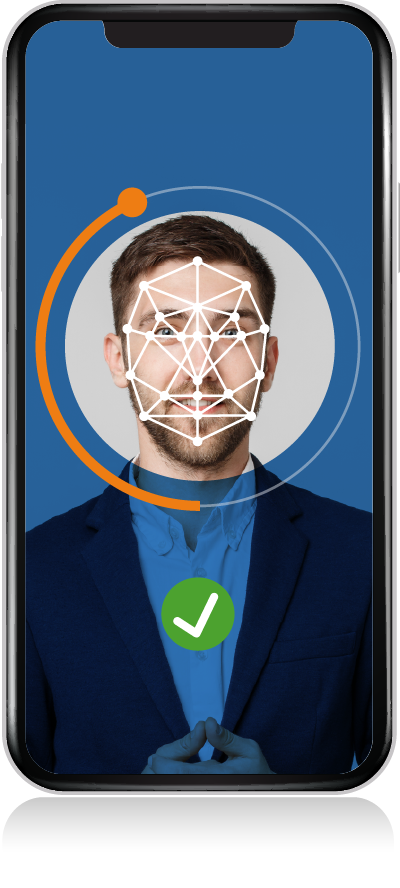

Unburden your team from the challenge of manual identity verification. Our cutting-edge facial matching technology instantly confirms that the face in a submitted ID matches the person present. A 50-point biometric facial comparison maps features as part of our identity verification process.

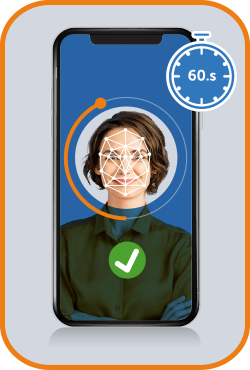

Liveness Checks confirm a real, live person is completing your identity verification process. ID-Pal Liveness Testing instantly assesses micro-variations in fraudulent techniques. This is why our Liveness Testing technology is independently certified to prevent the latest presentation attacks.

Reduce customer onboarding times with Address E-Verification. ID-Pal verifies an individual’s Name and Address against multiple databases during onboarding, ensuring one clear Full Address Match & removing the need for Proof of Address.

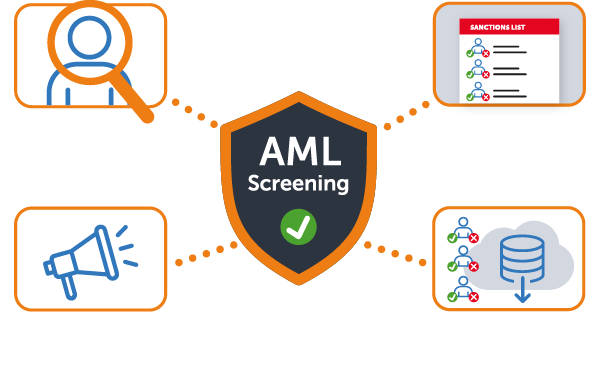

Add an additional layer of fraud prevention to your plan. Screen individuals in real-time against global PEPs and Sanctions lists. Perform adverse media checks across live sources and easily enroll individuals for periodic risk screening and ongoing monitoring.

Add-On Feature (additional cost)

Explore the additional features available that simplify compliance and offer robust fraud prevention.

This add-on feature enhances document verification and accuracy rates on each submission for the three most common types of document fraud attacks.

Match a customer’s validated data against over 160+ trusted data sources to verify an address in real-time automatically, as an additional verification and fraud prevention layer.

Screen individuals in real-time against global PEPs and Sanctions lists. Perform adverse media checks across live sources and easily enroll individuals for periodic risk screening and ongoing monitoring.

Have more questions? We’re here to help! Get in touch to find out more about our Identity Verification solutions.

Our Identity Verification and AML screening solution is tailored to meet the specific needs of accountants, offering an easy, efficient, and cost-effective way to achieve AML compliance:

USA

Ireland

United Kingdom

USA

USA

Ireland

UK

USA

Copyright © 2024 ID-Pal. All rights reserved.