Robustly detect and prevent common types of identity document fraud and produce detailed results for review.

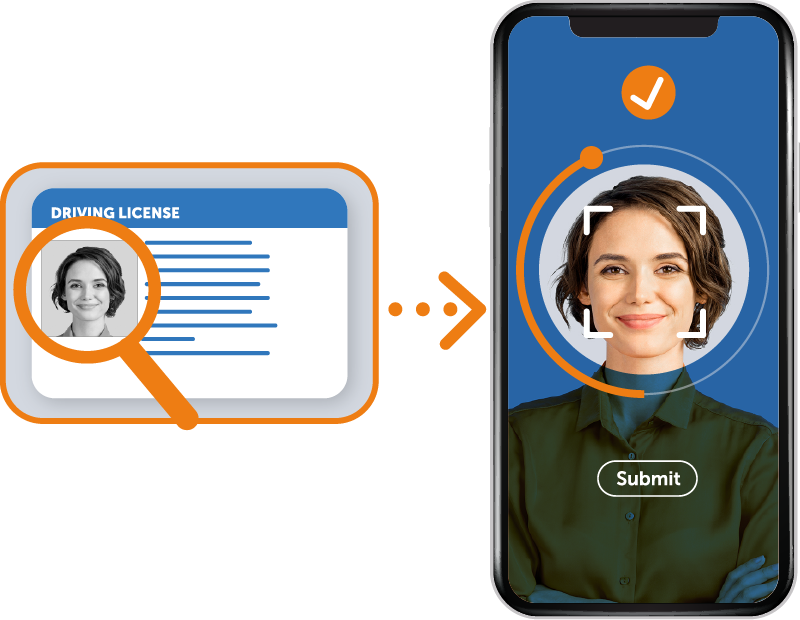

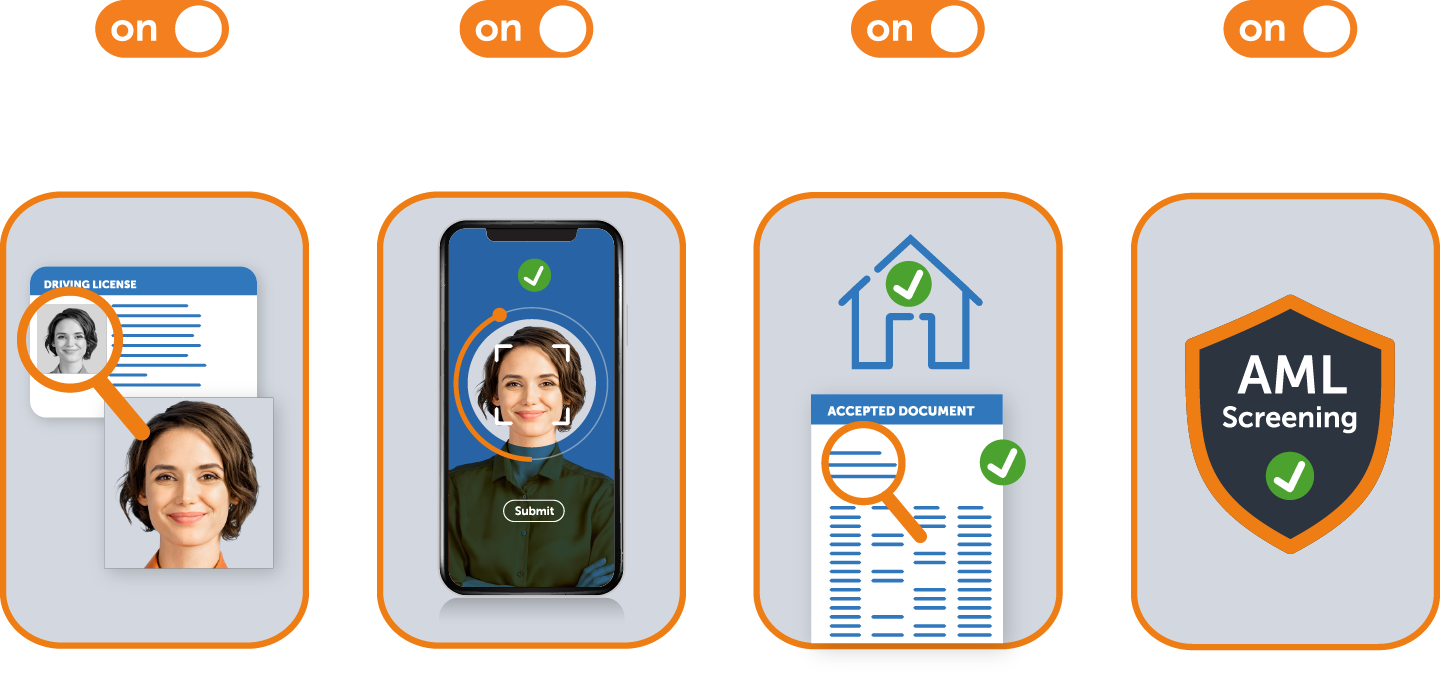

AI-powered technology verifies in real-time the authenticity of customers’ identity documents, ensuring that the person opening an account with your business is accurately identified, reducing your risk of fraud.

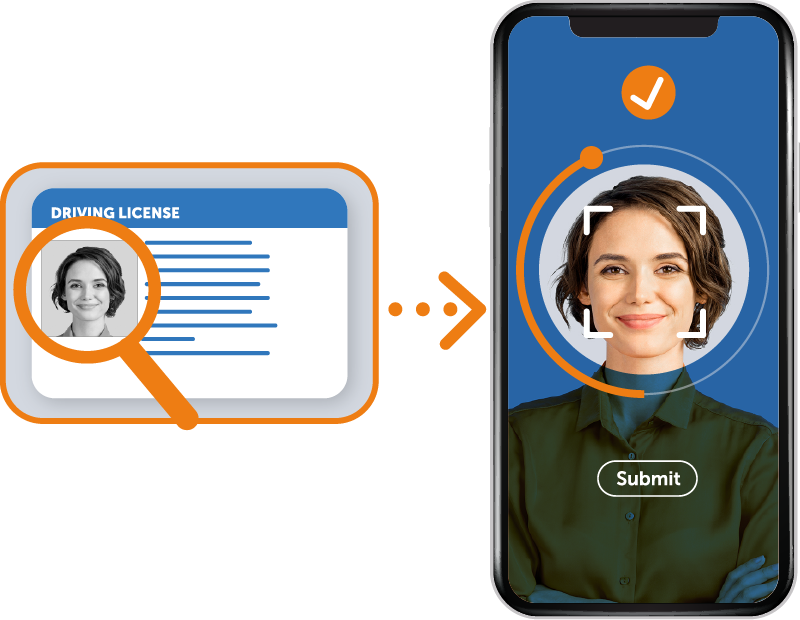

Our platform performs instant document verification, biometric facial matching, liveness detection and address verification checks for KYC.

With a user-friendly interface and seamless integration options, easily incorporate our solution into existing systems and workflows.

A digital reproduction of an identity document made using a device such as a mobile, tablet, computer, or monitor.

Have more questions? We’re here to help! Get in touch to find out more about our Identity Verification solutions.

Identity Document Verification confirms the authenticity of an individual’s identification documents, such as passports, driver’s licenses, or national ID cards. This verification process is essential in financial services to prevent fraud and ensure compliance with regulatory requirements.

The verification process typically involves several steps:

Identity Document Verification is crucial for businesses for several reasons:

Yes, our Identity Document Verification solution is designed to be flexible and easily integrated into existing systems.

We offer an out-of-the-box option and also offer an API (Application Programming Interfaces) and SDK (Software Development Kits) that enables seamless integration with a business’s current digital infrastructure, including customer onboarding platforms, eCommerce websites, and mobile applications.

This integration capability allows your business to add ID-Pal without disrupting the user experience or requiring significant transformation projects to integrate ID-Pal with their existing processes.

Additionally, we offer customisable features, allowing your firm to tailor the process to their compliance requirements.

USA

Ireland

United Kingdom

USA

USA

Ireland

UK

USA

Copyright © 2025 ID-Pal. All rights reserved.