Perform up to 70 technical identity document checks and instantly compare against data sources.

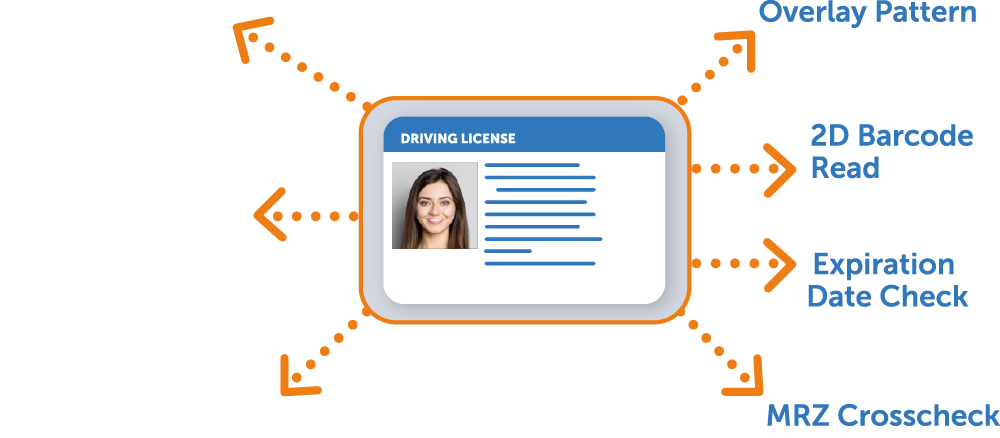

Digital document verification using advanced technical checks

Traditional ID verification uses the “1+1” or “2+2.” model, where an individual’s identity is validated using one or two pieces of identifiable information, against one or two databases.

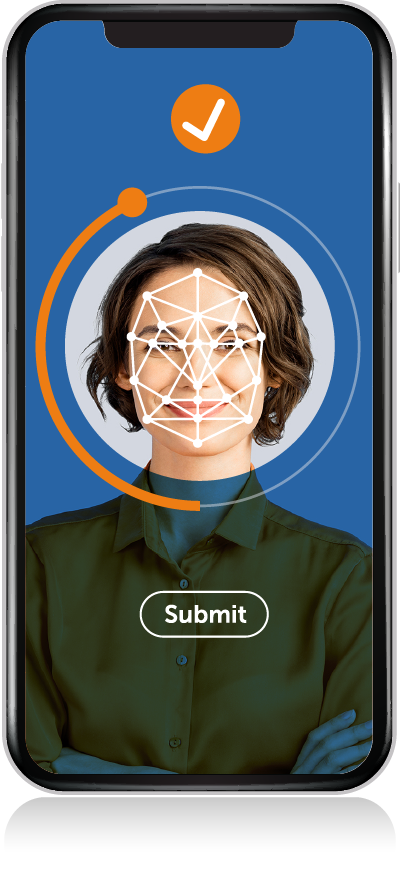

ID-Pal performs up to 70 technical checks per document, to ensure authenticity and detect fraud. Our multi-layered identity verification process verifies the facial image against the person.

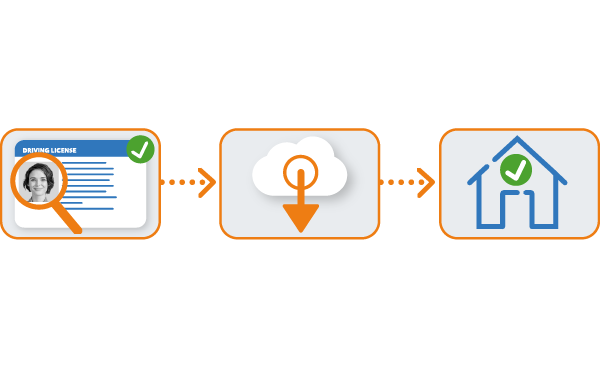

Send a link via SMS or email to initiate the Identity Verification process.

Your customer receives the link and uploads the identity documents requested.

The visible and machine-readable fields of IDs are crosschecked across sources.

Facial Matching technical check confirmed to match an authentic document.

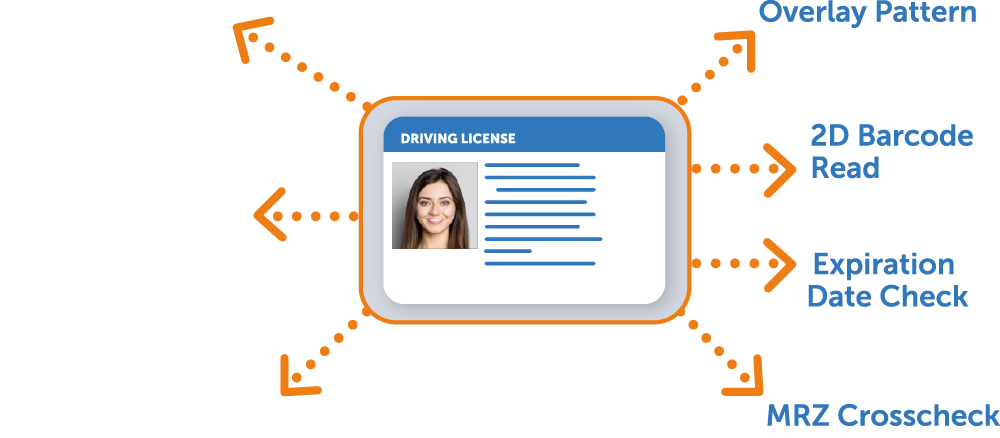

Our platform performs instant document verification, facial matching, liveness testing and address verification checks.

With a user-friendly interface and seamless integration options, easily incorporate our solution into existing systems and workflows.

Explore the additional features available

This add-on feature enhances document authenticity and accuracy rates on each submission via checks for document fraud.

Match against over 160+ trusted data sources to verify an address in real-time, as an additional layer of fraud prevention.

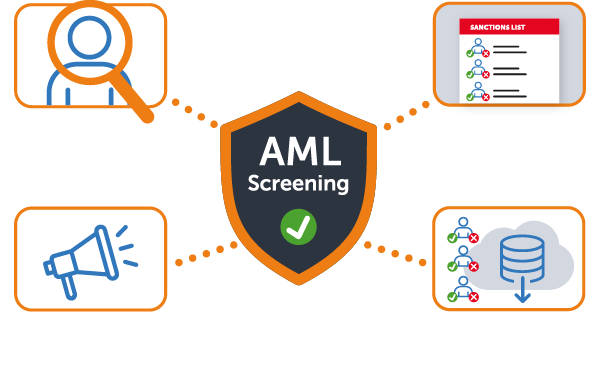

Instantly screen individuals against global sanctions lists. Perform adverse media checks across live sources. Enroll in ongoing checks.

Have more questions? We’re here to help! Get in touch to find out more about our Identity Verification solutions.

Identity document checks are essential procedures used to verify the authenticity of various official documents such as passports, driver’s licenses, or national ID cards. This process helps businesses and organisations confirm an individual’s identity and ensure compliance with legal and regulatory requirements. By using advanced verification technologies, identity document checks can detect alterations, counterfeits, and fraud, thereby protecting companies from potential security risks and enhancing overall trust in client transactions.

Identity document checks are crucial for preventing fraud, ensuring compliance with regulatory standards, and securing personal and organisational assets. They play a key role in industries such as banking, employment, and government services, where verifying a person’s identity is necessary to mitigate risks associated with identity theft and financial fraud.

For businesses, conducting these checks is part of due diligence processes required by laws like Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, ensuring that they operate legally and ethically.

Identity document checks streamline the customer onboarding process by providing a fast, efficient, and reliable method of verifying identities. Implementing these checks reduces the time and resources spent on manual verification, allowing companies to quickly onboard new customers while maintaining high security and compliance standards.

This not only improves the customer experience by making the process smoother and less intrusive but also helps businesses scale efficiently by automating and securing key parts of their customer intake workflow.

Discover more of ID-Pal’s technologies for identity verification and AML screening.

USA

Ireland

United Kingdom

USA

USA

Ireland

UK

USA

Copyright © 2025 ID-Pal. All rights reserved.