Industries

Deliver a seamless onboarding experience with real-time Identity Verification & AML Screening for the fintech industry.

Onboard users in real time using biometric, document and database checks for accurate results, robust fraud prevention and automated decisioning.

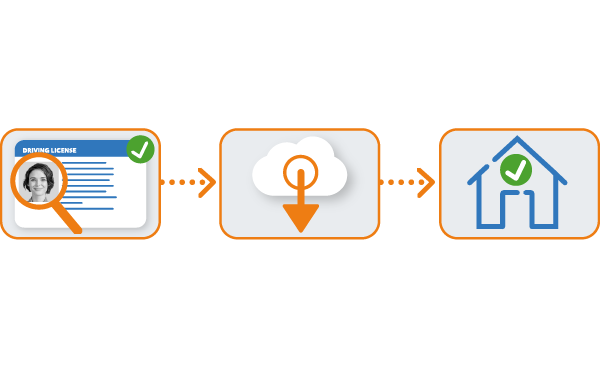

Capture, verify and securely store identity verification data from any point of onboarding to align offline and digital channels.

Onboard users in real time for increased conversions and reduced drop-off rates. Drive growth through acquisition across more markets and jurisdictions.

Multi-Layered

Deploying ID-Pal’s real-time identity verification and AML screening solution increases conversion rates, prevents fraud at source, ensures robust compliance whilst safeguarding your business from fraud.

Both ISO 27001 and 9001 certified, regulated fintechs can easily integrate ID-Pal via API or SDK, or off-the-shelf into existing systems. The user-friendly interface allows you to add the solution into your workflow, ensuring a hassle-free and efficient compliance process in line with your technology standards.

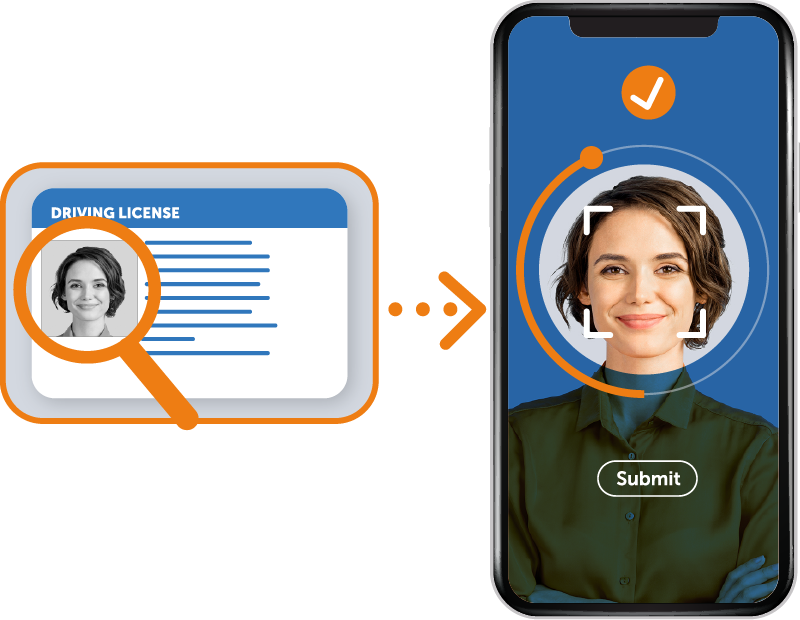

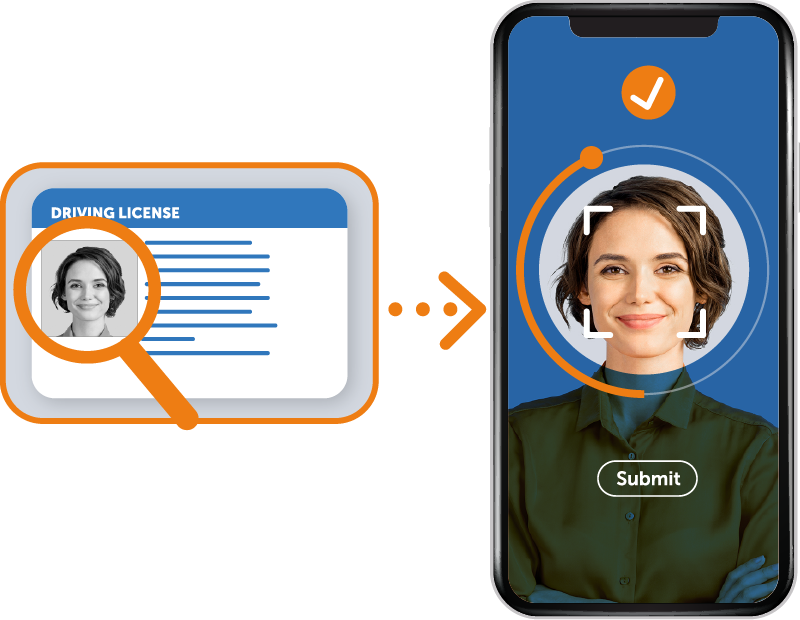

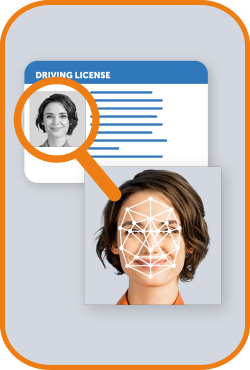

ID-Pal performs up to 70 technical checks per document, to ensure authenticity and confidently reject suspicious submissions. Our multi-layered identity verification process then verifies the facial image present.

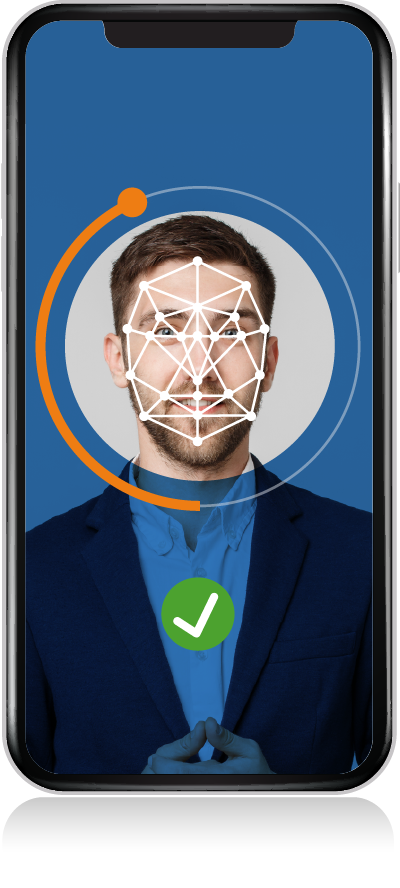

Unburden your team from the challenge of manual identity verification. Our cutting-edge facial matching technology instantly confirms that the face in a submitted ID matches the person present. A 50-point biometric facial comparison maps features as part of our identity verification process.

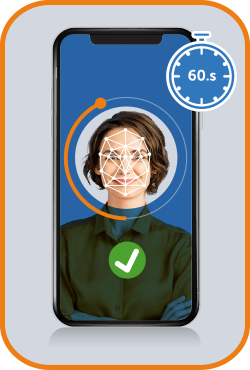

Liveness Checks confirm a real, live person is completing your identity verification process. ID-Pal Liveness Testing instantly assesses micro-variations in fraudulent techniques. This is why our Liveness Testing technology is independently certified to prevent the latest presentation attacks.

Reduce customer onboarding times with Address E-Verification. ID-Pal verifies an individual’s Name and Address against multiple databases during onboarding, ensuring one clear Full Address Match & removing the need for Proof of Address.

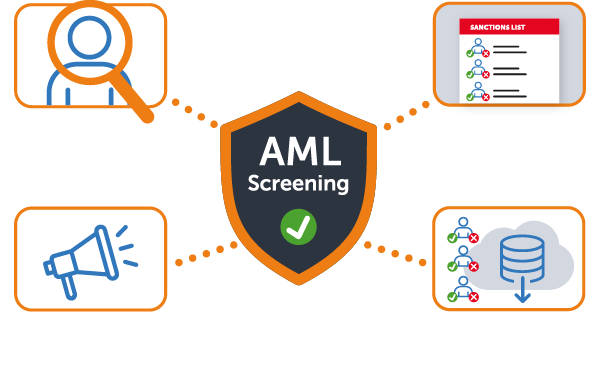

Add an additional layer of fraud prevention to your plan. Screen individuals in real-time against global PEPs and Sanctions lists. Perform Adverse Media checks across live sources and easily enroll individuals for periodic risk screening and Ongoing Monitoring.

Add-On Feature (additional cost)

Explore the additional features available that simplify compliance and offer robust fraud prevention.

This add-on feature enhances document verification and accuracy rates on each submission for the three most common types of document fraud attacks.

Match a customer’s validated data against over 160+ trusted data sources to verify an address in real-time automatically, as an additional verification and fraud prevention layer.

Screen individuals in real-time against global PEPs and Sanctions lists. Perform Adverse Media checks across live sources and easily enroll individuals for periodic risk screening and Ongoing Monitoring.

Have more questions? We’re here to help! Get in touch to find out more about our Identity Verification solutions.

For fintech companies, identity verification is pivotal in building a secure and trustworthy platform. It plays a critical role in preventing fraud, protecting user data, and ensuring compliance with global regulatory standards, such as KYC (Know Your Customer) and AML (Anti-Money Laundering).

Implementing a robust identity verification system enhances customer confidence and safeguards your fintech’s operations against identity theft and financial crimes, which is essential for maintaining the integrity of digital financial services.

Our identity verification solution offers fintechs a seamless, accurate, and efficient way to verify user identities. Leveraging advanced technologies like AI, biometric analysis, and live detection, it ensures a high level of security and compliance while providing a frictionless user experience.

This not only streamlines the onboarding process but also supports fintechs in meeting stringent regulatory requirements. Additionally, our solution is scalable and customizable, making it suitable for fintechs of all sizes and types, facilitating global expansion with confidence.

Our identity verification solution is designed for easy integration into fintech platforms. With our flexible API and SDK options, fintechs can quickly incorporate our verification processes into their existing systems without significant downtime or disruption.

This integration is supported by comprehensive documentation and our dedicated customer support team, ensuring a smooth transition.

The ease of integration means fintechs can enhance their security measures and improve user experience rapidly, staying ahead in the competitive digital finance landscape.

USA

Ireland

United Kingdom

USA

USA

Ireland

UK

USA

Copyright © 2025 ID-Pal. All rights reserved.