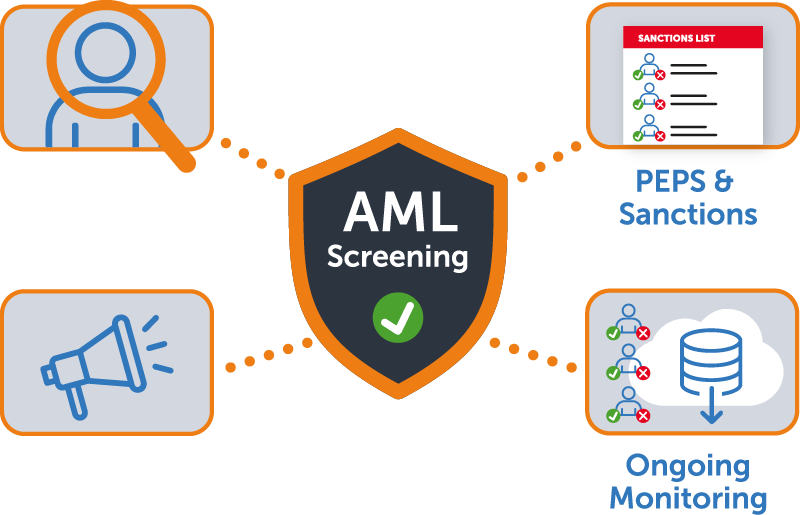

Comprehensive checks for PEPs & Sanctions or Adverse Media. Enroll in Ongoing Monitoring for automatic updates on AML screening.

Benefits of

Mitigate regulatory unknowns and the risk of money laundering using real-time Anti-Money Laundering (AML) screening with ongoing monitoring.

Check against watchlists across 200 countries and jurisdictions:

● U.S. sanctions list — Office of Foreign Assets Control (OFAC)

● EU sanctions list

● UK sanctions list — Office of Financial Sanctions Implementation (OFSI)

● Canada sanctions list

● UN sanctions list

● Interpol

● Government Agencies

● State Agencies

● Police Forces

and more

Simplify compliance in an ever-changing regulatory landscape with our end-to-end identity verification and AML Screening solution. Check against 6,000+ global watchlists and 20,000+ adverse media sources.

Uncover potential risk by identifying politically exposed people (PEPs) placed in influential positions, who could be exploited for illicit purposes.

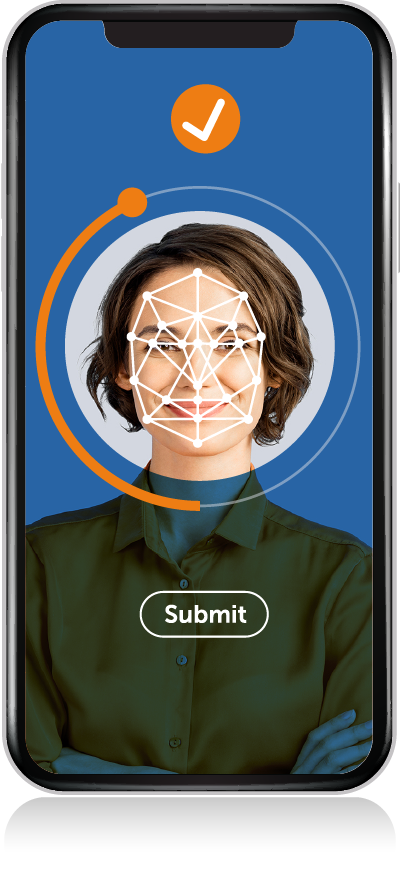

Pre-verify an identity and Address before AML screening to provide better data sets with more accurate outcomes.

Check for politically exposed persons who hold prominent positions or influence that can be abused for the purpose of financial crime.

Have more questions? We’re here to help! Get in touch to find out more about our Identity Verification solutions.

A PEP is a Politically Exposed Person. These individuals represent a higher level of money-laundering risk due to the fact that they, or someone close to them, hold a prominent position that makes them more vulnerable to negative influences such as bribery or corruption. Screening for PEPs enables businesses to identify these high-risk customers, thereby ensuring robust AML compliance measures are in place.

Other identity verification services we offer

USA

Ireland

United Kingdom

USA

USA

Ireland

UK

USA

Copyright © 2025 ID-Pal. All rights reserved.