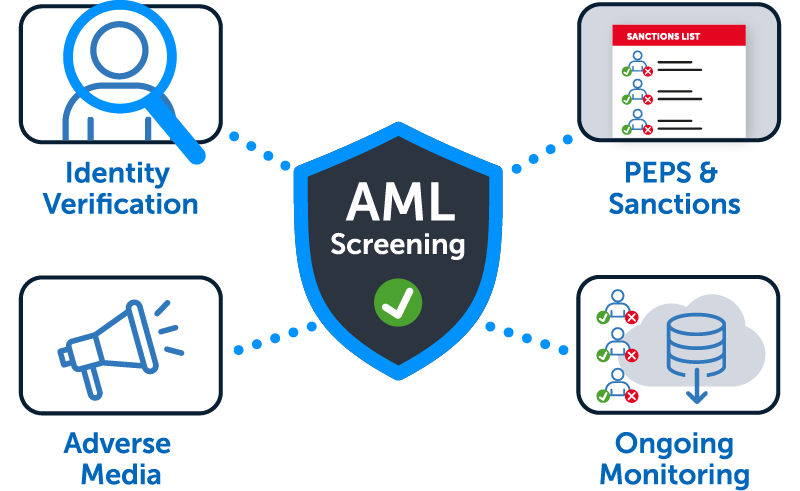

Screen customers against global watchlists and check for PEPs, sanctions and adverse media. Stay continuously protected with automated ongoing monitoring as regulations and risk profiles change.

Mitigate regulatory unknowns and reduce the risk of money laundering and other financial fraud. Protect and streamline your KYC and KYB onboarding checks with real-time Anti-Money Laundering (AML) screening, with ongoing monitoring.

The accurate first-time capture of KYC details combined with multi-layered identity and address checks reduces the burden and resources spent on false positives.

Seamlessly integrate global PEPs and sanctions checks, adverse media screening and the option for ongoing monitoring without having to re-upload data manually.

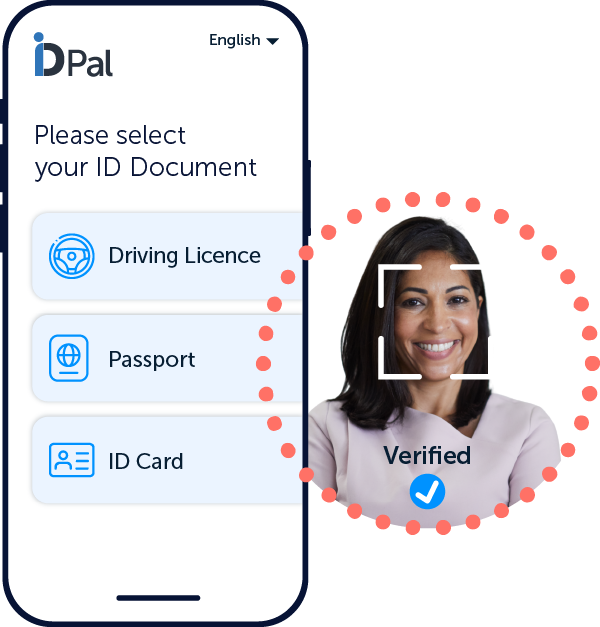

Speed up onboarding and pre-verify an identity and address before AML screening to provide better data sets -leading to more accurate outcomes.

ID-Pal’s AML screening checks against sanctions and watchlists across 250+ countries and jurisdictions:

● U.S. sanctions list — Office of Foreign Assets Control (OFAC)

● EU sanctions list

● UK sanctions list — Office of Financial Sanctions Implementation (OFSI)

● Canada sanctions list

● UN sanctions list

● Interpol

● Government agencies

● State agencies

● Police forces

and more

Uncover potential risk by identifying politically exposed people (PEPs) placed in influential positions, who could be exploited for illicit purposes.

Pre-verify an identity and Address before AML screening to provide better data sets with more accurate outcomes.

Check for politically exposed persons who hold prominent positions or influence that can be abused for the purpose of financial crime.

Have more questions? We’re here to help! Get in touch to find out more about our identity verification solutions.

100% AI-powered

Real-time verification

Zero access to customer data