Synthetic identity fraud is accelerating faster than most financial institutions can respond.

With deepfakes, GAN-generated imagery and increasingly professionalised fraud networks, the threat profile has changed, but too many verification workflows still depend on outdated manual reviews and hybrid controls. With the backdrop of New York, widely regarded as the financial hub of the Americas and the world being the stage for FinovateFall 2025, ID-Pal demonstrated why a fundamentally different approach is now required if banks and credit unions are to protect their customers, secure onboarding, and maintain trust.

“Fraud is evolving at the speed of AI.” – James O’Toole, Chief Business Officer & Co-Founder, ID-Pal

The Changing Threat: Deepfakes, Synthetic Identities and Manual Review Blind Spots

Looking around us at the pace of tech innovation and its often-subverted use towards fraudulent endeavours, it should be clear to all that legacy approaches involving human reviewers and offshore manual checks are no longer viable in a post-AI fraud environment. Fraudsters are now combining real stolen data with digitally fabricated imagery to generate synthetic identities designed to pass superficial checks.

“This legacy approach in a post-AI world is no longer fit for purpose. It’s what’s driving the massive rise in synthetic identity fraud.” – James O’Toole

Brought to life for this premier executive audience in full experiential fashion, AI-generated faces were showcased that have now become virtually impossible to distinguish from genuine imagery. The point was clear: if a human analyst cannot tell real from fake, then a fraudster will win the race unless defences evolve at the same speed.

Live on Stage: The Demo That Showed Fraud in Real Time

The FinovateFall walkthrough deliberately simulated fraud with an unusual twist. Instead of showcasing a smooth pass result as many technology vendors often do, ID-Pal demonstrated real-time detection of synthetic and tampered submissions, including photocopied identity documents.

Behind the scenes, ID-Pal’s orchestration engine was applying:

- Convolutional Neural Networks (CNNs) to verify expected document security features

- Visual transformers to detect anomalies or edits at pixel level

- Passive biometrics to verify the legitimate document owner

- Real-time database checks and sanctions screening for compliance completeness

As the document was analysed, the platform immediately flagged both photocopy submission and synthetic indicators exactly as intended.

ID-Detect: Stopping 99% of AI-Enabled Document Threat Vectors

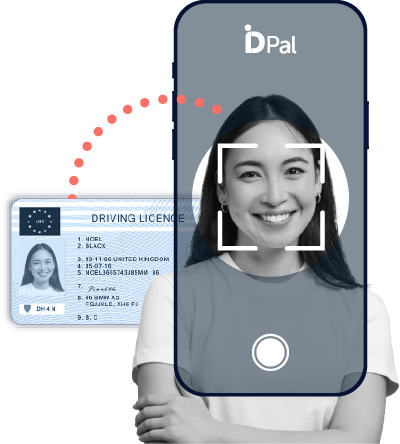

ID-Detect, ID-Pal’s premium enhanced verification suite designed specifically for AI-enabled fraud is central to the fight against the growing threat banks and credit unions face. By combining multi–layered document forensics with advanced biometrics, ID-Detect addresses the full stack of modern attack vectors not just basic forgeries.

This provides verification that is:

More accurate – driven 100% by AI decisioning

Faster – completed in real time

More secure – with zero access to customer data, preserving privacy

It is this privacy-preserving architecture that has made ID-Pal the chosen IDV partner for organisations including Mastercard, Salesforce, Ernst & Young, and the Department of Justice.

Biometric Re-Verification in Seconds: ID-Pal Once

The demo also introduced ID-Pal Once, enabling returning customers to be re-verified in moments using biometric authentication ideal for step-up checks and high-risk transactions.

This minimises user friction while strengthening controls at critical moments such as:

- Loan origination

- Wire transfers

- Account recovery

- High-value authorisations

The session was concluded with a clear and highly pertinent reality: “Staying ahead of fraud is not simply about catching today’s attacks, it is about preparing for tomorrows.” So, the question to ask yourself on behalf of your business, is – do you truly feel safe and ready for the threats set to come?

ID-Pal’s AI-driven approach provides financial institutions with the accuracy, speed and resilience needed to counter the next wave of identity fraud, while delivering a user experience that customers expect.

Watch the Live Demo

To see how ID-Pal detects synthetic identities, deepfakes and tampered documents in real time, watch the live FinovateFall 2025 demo: