When it comes to protecting the financial system, accountants are essential in keeping order. However, there is no denying the truth: financial scams are increasingly prominent. Money laundering and non-compliance costs companies billions in fines every year – $5.35bn in 2021 to be exact. And yet, so many businesses are ill-equipped to manage such a risk.

As trusted financial advisers, it’s vitally important that accounting firms put strong processes in place to ensure compliance at all times. With so many conflicting regulations at play, from AML and KYC to GDPR, there is a lot of complexity and risk for these firms in managing their customers’ information. Any breach could have serious knock-on effects and yet there is a continued dependence on manual verification of identity documents, back-office admin processes and compliance.

Balancing compliance and convenience

The challenge for accountants is to find a way to satisfy their regulatory obligations in an affordable and efficient manner, while still offering a convenient experience for their customers. To do so, the industry must embrace tech solutions that both reliably simplify the verification processes in smaller firms as well as integrate seamlessly with larger enterprises via API or SDK.

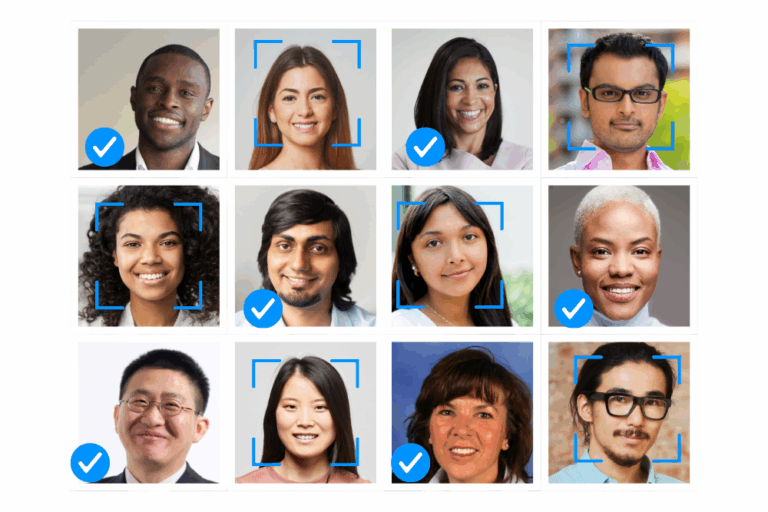

Digital identity verification solutions like ID-Pal ensure GDPR compliance, while instantly performing multi-layered verification that includes Biometric, Facial and Document checks and Address Verification, to protect the business from fraudulent activity.

How ID-Pal can streamline AML and KYC for Accountants

In ID-Pal, we can carry out 50 technical checks in real-time, and can do so with over 6000 documents from over 200 countries and jurisdictions. Such extensive and expedited checks would not be possible with a more manual system. Trusted technology minimises the likelihood of an accountancy firm onboarding a customer who has associations with money laundering, terrorist financing, and other illegal activities.

The benefits of a strong regtech solution are clear: robust AML compliance and increased back-office efficiencies that save time and money. Legitimate clients, on the other hand, will enjoy an intuitive and hassle-free experience.

Accountants are keenly aware of the need to protect their business and their clients from financial fraud but doing so shouldn’t be a cumbersome process. Using technology can grant accountants the confidence that they are protected from fraud, saving their team time that could be spent focusing on growing their business and keeping them one step ahead of fraudsters.

Contact us today for a live demo of how the ID-Pal service can be easily integrated with your business.