Industries

Automatically verify a credit union members’ identity and address in real time, while performing OCAF Screening in parallel.

Stay audit ready using ID-Pal for identity verification of new members. A comprehensive Customer Due Diligence report is generated per submission.

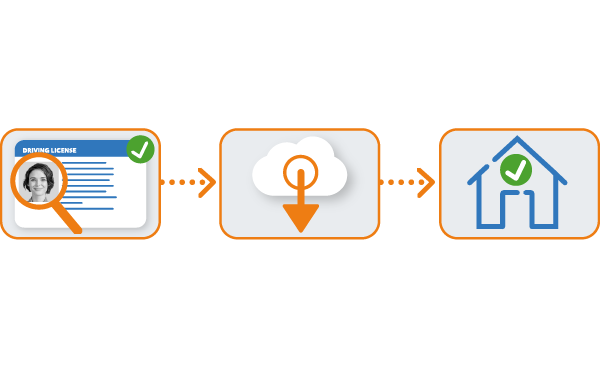

Capture, verify and securely store identity verification data from any point of onboarding to align offline and digital channels.

Onboard members in real time for increased conversions and drive growth through acquisition. Customise the onboarding journey in seconds.

Multi-Layered

ID-Pal offers Credit Unions an easy to implement out-of-the-box solution to support the digital transformation of their members’ onboarding process, ensuring a smooth member journey while proactively preventing fraud.

The seamless onboarding of members is delivered via an award-winning branded user experience, whether in-person in a branch, or remotely online.

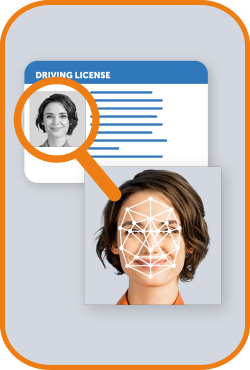

ID-Pal performs up to 70 technical checks per document, to ensure authenticity and confidently reject suspicious submissions. Our multi-layered identity verification process then verifies the facial image present.

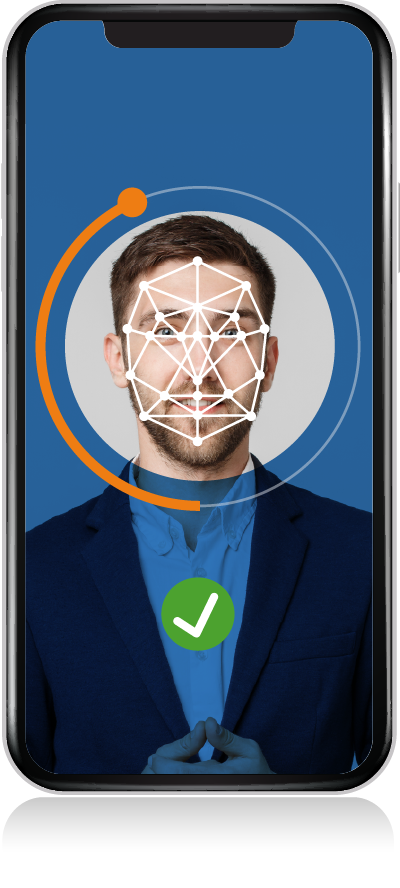

Unburden your team from the challenge of manual identity verification. Our cutting-edge facial matching technology instantly confirms that the face in a submitted ID matches the person present. A 50-point biometric facial comparison maps features as part of our identity verification process.

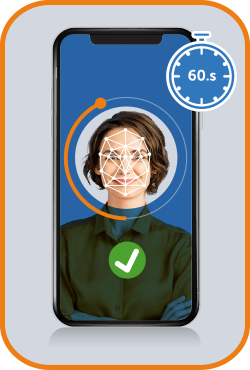

Liveness Checks confirm a real, live person is completing your identity verification process. ID-Pal Liveness Testing instantly assesses micro-variations in fraudulent techniques. This is why our Liveness Testing technology is independently certified to prevent the latest presentation attacks.

Reduce customer onboarding times with Address E-Verification. ID-Pal verifies an individual’s Name and Address against multiple databases during onboarding, ensuring one clear Full Address Match & removing the need for Proof of Address.

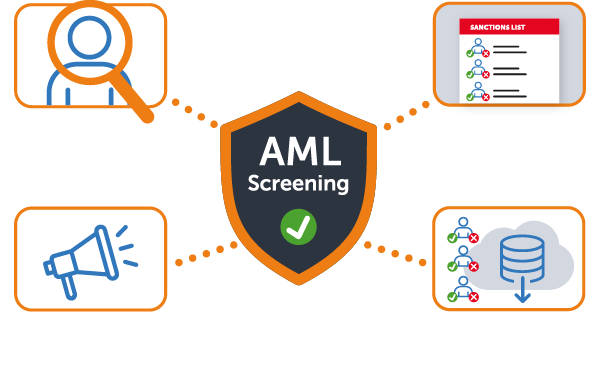

Add an additional layer of fraud prevention to your plan. Screen individuals in real-time against global PEPs and Sanctions lists. Perform Adverse Media checks across live sources and easily enroll individuals for periodic risk screening and Ongoing Monitoring.

Add-On Feature (additional cost)

Explore the additional features available that simplify compliance and offer robust fraud prevention.

This add-on feature enhances document verification and accuracy rates on each submission for the three most common types of document fraud attacks.

Match a customer’s validated data against over 160+ trusted data sources to verify an address in real-time automatically, as an additional verification and fraud prevention layer.

Screen individuals in real-time against global PEPs and Sanctions lists. Perform Adverse Media checks across live sources and easily enroll individuals for periodic risk screening and Ongoing Monitoring.

Have more questions? We’re here to help! Get in touch to find out more about our Identity Verification solutions.

Identity verification is paramount for credit unions to safeguard against fraud, ensure compliance with regulatory standards, and build trust with members. It’s a critical component in preventing identity theft and financial crimes, such as money laundering.

By implementing robust identity verification processes, credit unions can enhance the security of their operations and member transactions, meeting KYC (Know Your Customer) and the Office of Foreign Assets Control (OFAC) requirements.

This not only protects the financial integrity of the credit union but also reinforces the trust and confidence of its members in the institution’s ability to secure their assets and personal information.

Our identity verification solution is designed to meet the unique needs of credit unions, offering a secure, efficient, and member-friendly verification process.

By integrating advanced technologies such as biometric analysis and real-time data checks, we provide credit unions with the ability to quickly verify the identities of new and existing members while ensuring compliance with OFAC and KYC regulations.

Our solution minimises the potential for fraudulent activities, streamlines member onboarding, and enhances the overall member experience by reducing wait times and manual errors. Additionally, our scalable solution can be easily adapted as your credit union grows or as regulatory requirements evolve.

Integration of our identity verification solution into credit union systems is straightforward and seamless, designed to minimise disruption to existing operations. Our solution comes with comprehensive API and SDK support, enabling easy integration with your credit union’s current banking and customer management systems.

We provide full technical support and documentation to ensure a smooth transition, allowing credit unions to enhance their identity verification processes without significant IT overhead or extensive training requirements. This ease of integration means credit unions can quickly benefit from improved security, efficiency, and regulatory compliance.

USA

Ireland

United Kingdom

USA

USA

Ireland

UK

USA

Copyright © 2025 ID-Pal. All rights reserved.