Streamline investor onboarding with fast, accurate identity verification built to meet the regulatory demands of fund admin.

At ID-Pal, we understand that fund administrators face pressure to balance regulatory compliance, operational efficiency, and client expectations – all against a backdrop of rapidly evolving fraud threats and an increasing administrative burden.

Effective identity verification is central to addressing these challenges and ensuring a quick and secure onboarding experience.

Fund admins must navigate constantly evolving AML, KYC, and data protection rules. Manual checks increase the risk of non-compliance, fines, and reputational damage.

Disconnected systems and manual workflows slow onboarding, risk errors, and drive up operational costs, limiting the ability to scale efficiently.

Identity fraud, phishing, deepfakes and cyber threats puts sensitive client and fund data at risk, threatening both compliance and investor trust.

Clients want faster onboarding, transparency, and secure interactions. Slow or cumbersome verification processes can harm retention and competitiveness.

Stay ahead of evolving compliance requirements with an all-in-one KYC solution that lets fund admins effortlessly verify the identities of all parties involved in the fund lifecycle, from investors to service providers.

ID-Pal’s AI-powered identity verification platform uses the latest tools to spot deepfakes and sophisticated fraud attempts, reducing potential losses and preventing reputational damage.

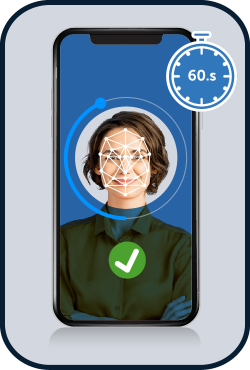

Our platform can verify your client’s identity in less than five seconds whilst performing AML screening in parallel – speeding up onboarding flows and freeing up your time for more strategic activities.

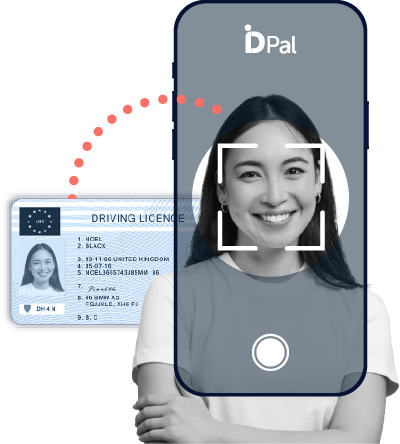

ID-Pal delivers all the core identity verification capabilities fund administrators need in one easy-to-use platform. ID document checks, biometric facial matching, AML screening and proven liveness detection work together to confirm identity with precision and prevent impersonation attempts.

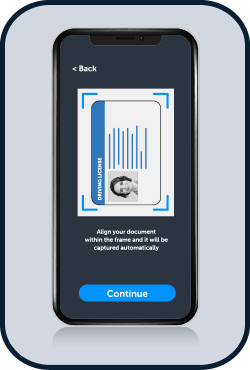

Integrate ID-Pal into your onboarding flow in just a single day – whether you’re onboarding new clients in-person or remotely, or authorising high-value transfers, our platform can start saving you time in just minutes.

ID-Pal performs up to 70 technical checks per document, to ensure authenticity and confidently reject suspicious submissions. Our multi-layered identity verification process then verifies the facial image present.

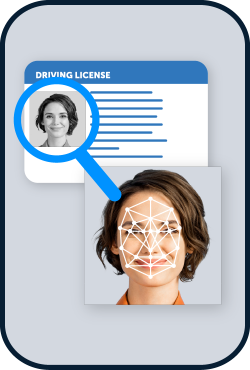

Unburden your team from the challenge of manual identity verification. Our cutting-edge facial matching technology instantly confirms that the face in a submitted ID matches the person present. A 50-point biometric facial comparison maps features as part of our identity verification process.

Liveness Checks confirm a real, live person is completing your identity verification process. ID-Pal Liveness Testing instantly assesses micro-variations in fraudulent techniques. This is why our Liveness Testing technology is independently certified to prevent the latest presentation attacks.

Reduce customer onboarding times with Address E-Verification. ID-Pal verifies an individual’s Name and Address against multiple databases during onboarding, ensuring one clear Full Address Match & removing the need for Proof of Address.

Add an additional layer of fraud prevention to your plan. Screen individuals in real-time against global PEPs and Sanctions lists. Perform adverse media checks across live sources and easily enroll individuals for periodic risk screening and ongoing monitoring.

Add-on feature (additional cost)

Ardan is an international wealth management platform providing high-quality services to its clients. As part of their commitment to ensuring a seamless, secure experience, the company sought innovative ways to enhance their onboarding process while maintaining stringent fraud prevention measures.

Fund admin involves complex, regulated workflows across onboarding, investor lifecycle management, transfers and periodic reviews. Each stage demands accurate, fast identity verification to maintain regulatory compliance and protect against fraud.

ID-Pal supports every touchpoint with a single, reliable identity verification solution that fits the way fund administrators work.

Accelerate initial due diligence with instant document checks, biometric matching, and automated screening. Reduce manual effort during account opening workflows.

Support core TA tasks such as subscriptions, redemptions, changes of address, and authorised signatory updates. Ensure every change is verified, auditable, and protected against fraud.

Strengthen security for sensitive interactions like transfer requests, payment changes, or investment amendments. Verify identity in seconds to prevent impersonation and financial fraud.

Simplify ongoing KYC refresh and remediation work with automated re-verification. Reduce operational burden while staying aligned with evolving regulatory expectations.

Have questions about improving identity verification across your fund admin workflows? Speak with our team to see how ID-Pal can strengthen your investor onboarding and prevent fraud losses.

Faster and fully compliant investor onboarding

Less manual effort

Stronger fraud prevention

Identity verification is critical for fund administrators because it underpins regulatory risk and compliance requirements.

Beyond compliance, a strong identity verification platform like ID-Pal protects fund operations from impersonation, identity fraud, and unauthorised transactions, particularly during onboarding, transfers, and high-value requests. As funds scale and investor expectations increase, digital identity verification also enables faster onboarding, lower operational costs, and consistent auditability across complex, high-volume workflows.

ID-Pal performs automated identity verification and risk-based AML screening in parallel. This creates a repeatable, auditable process that supports regulatory obligations, reduces human error, and helps compliance teams demonstrate control during audits and inspections.

Yes, our identity verification solution is designed for easy integration with the existing systems and workflows of fund admins. Our flexible API and SDK options allow for a seamless implementation into your current infrastructure, enabling a smooth transition and minimal disruption to your operations.

Our out-of-the-box option allows fund admins to enhance their KYC and AML processes in just one day, without needing a lengthy overhaul of your existing processes at a great cost.

Multi-layered digital identity verification replaces manual, paper-based checks with automated, real-time processes. This significantly reduces onboarding times, eliminates repetitive data entry, and minimises human error.

For fund administrators handling high volumes of investors and transactions, this leads to faster processing, lower operational costs, and the ability to scale without increasing compliance headcount.

Yes, the ID-Pal platform can be used by fund administrators to ensure fast and reliable identity verification at every stage

Our platform supports multiple fund admin use cases requiring digital identity verification, including changes of address, authorised signatory updates, high-value transactions, redemptions, and account amendments.

ID-Pal uses biometric facial matching, liveness detection, and secure document verification to prevent impersonation, identity theft, and social engineering attacks. These controls help stop fraud at the point of onboarding or transaction approval. ID-Pal employs AI tools to help protect fund admins from sophisticated deepfakes and other evolving threats.

We also offer KYC and AML screening, including comprehensive checks for PEPs and sanctions, adverse media and checks against global watchlists.