Automate KYC, KYB and AML checks to onboard clients faster, reduce compliance risk, and free up your fee earners to focus on complex, high-value casework.

Legal firms face increasing pressure to balance strict regulatory obligations whilst protecting their margins and maintaining an efficient service for their clients.

A rising number of ever-more sophisticated fraud attempts, complex AML and KYC/B requirements, and paper-based manual onboarding processes all create friction, cost, and exposure to risks if not properly managed.

Legal firms must comply with strict Anti-Money Laundering (AML) and Know Your Client (KYC) regulations, as well as providing a comprehensive firm-wide risk assessment (FWRA). Failure to properly verify clients or adequately manage the risks facing your firm can lead to regulatory penalties, sanctions breaches, and reputational damage.

Legal firms are increasingly targeted by fraudsters – fake identities, stolen documents, shell companies, and impersonation attempts are common. Without robust identity verification in place, firms risk falling victim to sophisticated attacks or being exploited to facilitate financial crime or fraud, with severe consequences.

Traditional, paper-based onboarding is slow, error-prone, and resource-intensive. Fee earners can spend hours on complex document checks and identity verification, diverting attention from high-value casework. Manual processes also make audits and compliance reporting slower and more costly.

As legal work becomes increasingly digital and services cross borders, verifying international clients remotely introduces new risks. Ensuring authenticity across a range of international documents, languages, and jurisdictions is difficult, and inconsistent processes increase liability and client friction.

Our platform uses the latest tools and technologies, including AI, to identify and flag fraud attempts such as deepfakes, impersonation and screen recapture – preventing bad actors from gaining access to your firm.

Automating identity verification, screening and document checks greatly speeds up client onboarding, freeing up your fee earners to focus on more complex cases and saving your firm time and money.

Check clients against global PEPs and sanctions lists, ensure compliance with KYB, KYC and AML requirements and maintain a comprehensive audit trail so you know exactly who you’re doing business with.

Using a platform that provides seamless KYC verification for individuals in our major jurisdictions is an important component to efficient and effective client on-boarding. ID-Pal has the technology to support our aims and has helped us to quickly offer compliant, reliable virtual individual verification at a time when we needed it most. We are looking forward to continuing to build on this relationship in the future.

Legal firms rely on ID-Pal to manage client onboarding and identity checks to reduce risk, without slowing cases down.

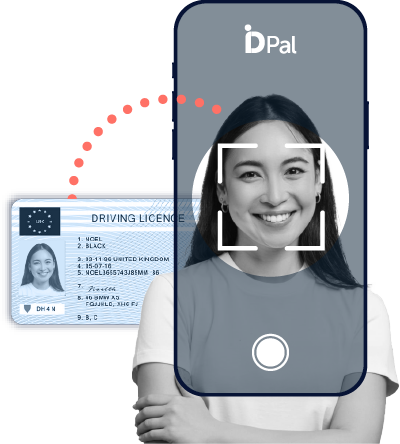

Our platform combines document authentication, biometric verification, and advanced liveness technology to ensure firms are dealing with genuine clients from the outset.

Effortlessly screen individuals and businesses for PEPs and sanctions, adverse media, directorships and more in a single automated KYC / KYB flow.

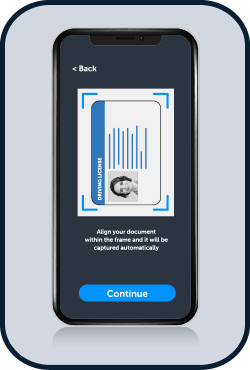

Verifies government-issued identity documents to confirm an individual’s legal identity during client onboarding. Supports passports and national identity documents, with automated checks to validate authenticity, document integrity, and data consistency. Designed for use by legal firms operating under AML and client due diligence obligations, with results that can be retained for audit and regulatory review.

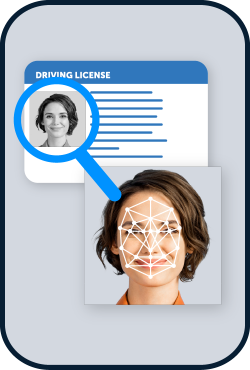

Uses biometric facial comparison to match a live facial capture against the photograph on a verified identity document. Confirms that the individual presenting the document is the legitimate holder, reducing the risk of impersonation and identity misuse. Commonly used by legal firms as part of remote onboarding processes.

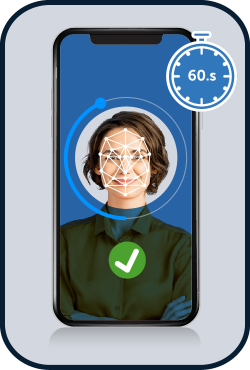

Performs liveness checks to confirm that the individual completing identity verification is physically present at the time of the assessment. Detects attempts to use static images, pre-recorded videos, or other spoofing methods. Supports secure remote verification workflows used by legal organisations handling sensitive client and transaction data.

Verifies an individual’s residential address using submitted information and trusted data sources. Supports legal and AML requirements where proof of address is required as part of client due diligence. Helps legal firms confirm address details efficiently while maintaining consistent records for compliance and audit purposes.

Verifies business entities by checking company registration data, ownership structures, and associated individuals, and supports AML compliance obligations. Used by legal firms conducting due diligence on corporate clients, including identification of directors and beneficial owners, as well as matters involving company formation, transactions, and ongoing compliance.

Sherry FitzGerald is a leading property advisory firm based in Ireland. Onboarding new customers every day across numerous offices across the country, Sherry FitzGerald was looking for a solution that would integrate seamlessly into their business, whilst making the process simpler and more convenient for both themselves and their clients.

Legal work spans client onboarding, conveyancing, corporate transactions, and ongoing due diligence. Each stage carries regulatory obligations and fraud risk, requiring identity and business checks that are accurate, consistent, and auditable.

ID-Pal supports legal teams across these touchpoints with a single identity verification platform designed to fit real legal workflows.

Automate client identity checks and ongoing verification to meet AML and KYC/B requirements with confidence. Maintain clear audit trails and reduce the risk of non-compliance as regulations evolve.

Protect your firm from identity fraud, document manipulation, and impersonation attempts. Advanced document verification and biometrics help ensure you are dealing with genuine clients.

Reduce the delays and inherent risk caused by manual document and identity checks and in-person meetings. Verify clients quickly and reliably, freeing up time for more strategic matters and high-value casework.

Standardise identity verification across departments, offices, and practice areas. Strengthen compliance by removing reliance on manual judgements and ensure every client is verified to the same standard.

Have questions about improving identity verification and compliance checks across your legal workflows? Speak with our team to see how ID-Pal can save you time and money whilst keeping you on the right side of evolving regulatory requirements.

Faster and fully compliant onboarding

Stronger fraud prevention

Eliminate manual work

Many legal services are subject to identity verification requirements, particularly those involving financial transactions or asset transfer. This includes conveyancing, property law, corporate and commercial work, trusts and estates, and company formation.

Additionally, many services will require KYB (Know Your Business) and AML (Anti-Money Laundering) checks to ensure the probity of businesses and their ownership structures.

Digital identity verification allows law firms to confirm client identity using secure, standardised checks aligned with AML and KYC/B obligations. It also creates clear audit trails, making it easier to demonstrate compliance during regulatory reviews or inspections.

The data and insights gained from these comprehensive checks can be used to support decision-making and the creation of frameworks such as the FRWA (Firm-Wide Risk Assessment) and CMRA (Client Matter Risk Assessment).

Identity verification is critical for regulated legal firms because it underpins regulatory risk and compliance requirements.

Beyond compliance, a strong AML platform like ID-Pal protects firms from impersonation, identity fraud, and unauthorised transactions, particularly during client onboarding, high-value transactions, and matters involving corporate entities. As firms grow and client expectations increase, digital identity verification also enables faster onboarding, lower operational costs, and consistent auditability across complex, high-volume workflows.

Yes. ID-Pal enables legal firms to verify clients remotely without the need for in-person meetings or physical document handling. This allows firms to onboard clients more quickly whilst maintaining consistent compliance standards, regardless of jurisdiction.

ID-Pal supports verification of individuals associated with corporate entities, including directors, people with significant control (PSCs), and beneficial owners – all in one automated, fully-auditable flow. This helps legal firms meet enhanced due diligence requirements and manage complex ownership structures more effectively. account amendments.

ID-Pal is an out-of-the-box solution that is designed to integrate seamlessly with existing systems and processes, and can be deployed rapidly with minimal technical overheads.

With deployment and customisation typically taking less than a day, legal teams can begin using the platform almost immediately to start reducing manual checks and improve onboarding efficiency.

The best onboarding solution for legal firms is one that enables compliant client onboarding while minimising cost, delay, and operational effort. In practice, this means a platform that combines identity document verification, biometric checks, address verification, and AML/KYB support, with secure record-keeping suitable for audit and regulatory review. It should support remote onboarding and integrate with existing legal workflows.

A strong legal onboarding solution must also reflect how legal firms actually work: guided implementation, configurable processes, clear evidencing of checks performed, and explicit retention of compliance responsibility with the firm.

ID-Pal is built specifically for regulated organisations, including legal firms, that require high-assurance identity verification and auditable outcomes. It combines document verification, facial matching biometrics, liveness testing, address verification, and KYC/B capabilities in a single platform. ID-Pal supports AML and client due diligence workflows while providing clear audit trails, allowing legal firms to easily meet regulatory obligations without friction.