Cut onboarding times and reduce manual work with a single, streamlined verification flow powered by AI.

Transform customer onboarding in just a day with our off-the-shelf identity verification solution. Integrate the platform seamlessly with existing processes via our API/SDK.

Simple, secure and convenient digital onboarding for robust KYC and AML compliance, all in one flow.

Easily integrate ID-Pal into your existing systems and customise your front-end in one click – no complex requests, coding or development work required.

All paths are designed with our award-winning journey and can be tailored to your specific requirements.

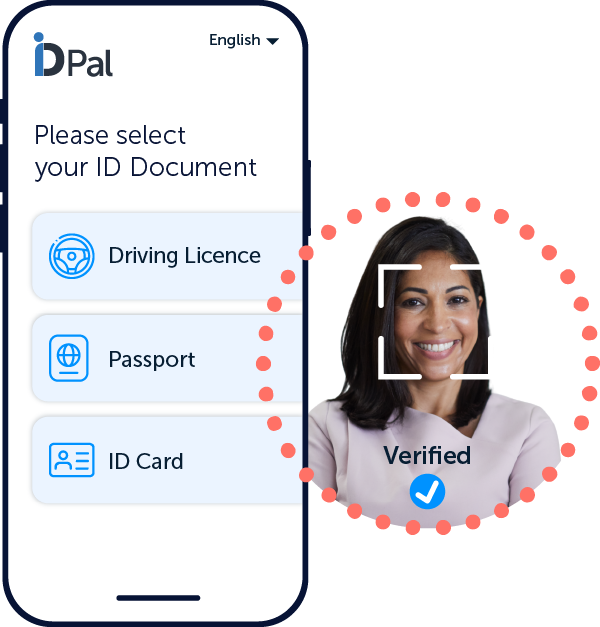

Intuitive and frictionless customer onboarding using our award-winning native mobile app journey.

Seamlessly integrate a no-code customisable web journey with existing processes to transform onboarding.

Our award-winning platform can onboard customers online, in-person or remotely in seconds and secure all your touchpoints from fraud on any device.

Covering 8000+ identity documents from across 250+ jurisdictions, enjoy enhanced verification using 400+ trusted data sources.

Our platform offers seamless customer onboarding across all channels.

ID-Pal offers a fully encrypted IDV process and has zero access to customer data at any stage of the flow.

Send customers a link to verify their identity and address securely in seconds.

Allow admin or agents to directly issue links. Each submission has a unique ID, with an automatic CDD report generated and accessible in the secure business portal.

Deploy a tailored solution at speed and scale without the complexity and cost of a typical remediation project.

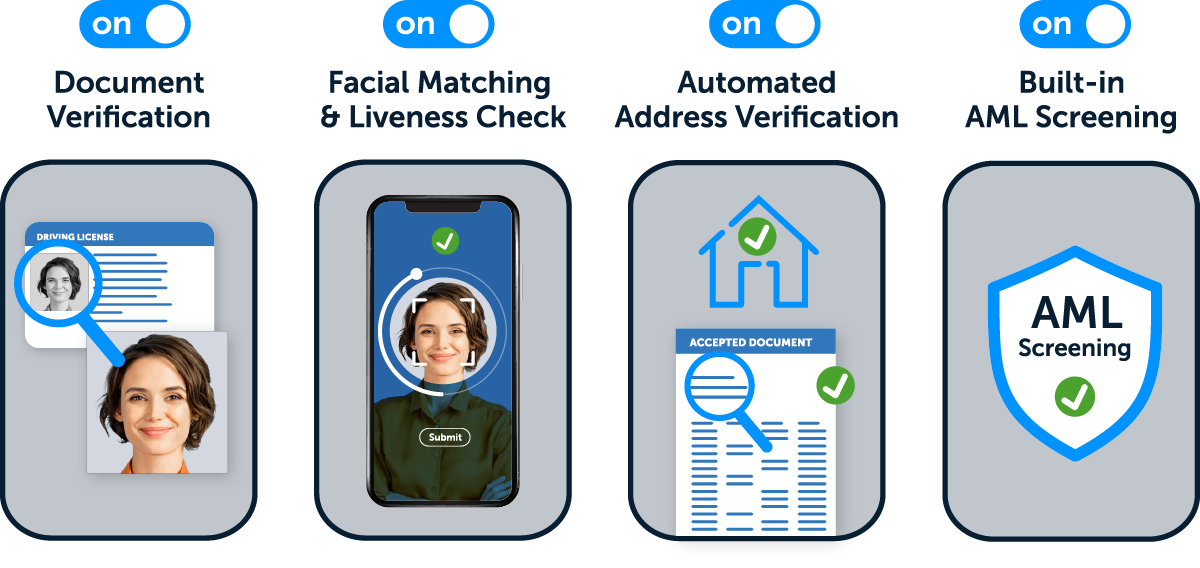

Conduct instant checks for document verification, biometric facial matching, liveness detection and address verification.

Offer a user-friendly experience to your customers during onboarding using our award-winning ID verification solutions.

Learn how our customers prevent fraud and simplify compliance

Have more questions? We’re here to help! Get in touch to find out more about our identity verification solutions.

100% AI-powered

Real-time verification

Zero access to customer data

Identity verification during customer onboarding is a critical process that involves confirming the authenticity of a customer’s identity documents to ensure they are who they claim to be. This step is crucial for businesses to comply with regulatory requirements, prevent fraud, and establish trust.

It typically involves collecting personal identification details, verifying these details against trusted sources, and using technologies like biometric verification to confirm physical identity. Implementing thorough identity verification ensures a secure start to the customer-business relationship and lays the foundation for future transactions.

Identity verification is essential in customer onboarding for several key reasons:

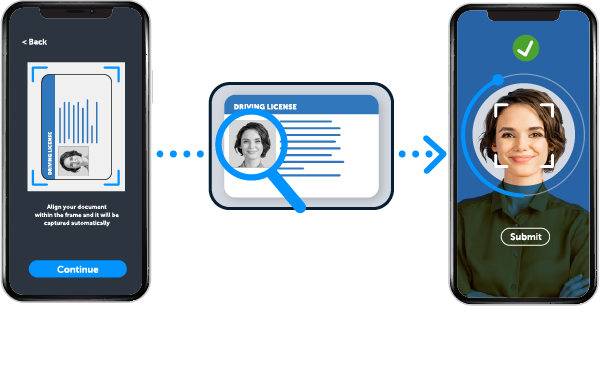

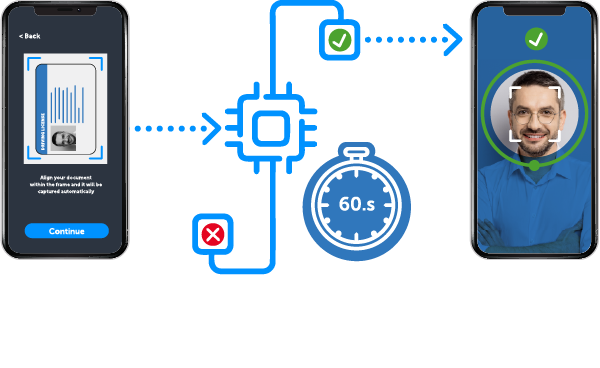

Technology significantly enhances identity verification processes during customer onboarding by improving accuracy, efficiency, and user-friendliness. Automated Document Verification, using technologies like Optical Character Recognition (OCR), quickly and accurately extracts data from identity documents.

Biometric Verification methods, such as facial recognition or fingerprint scanning, add a layer of security by matching the physical characteristics of the customer with the provided documents.

Real-Time Verification allows for the verification of customer details in real-time, speeding up the onboarding process and reducing the potential for errors. Additionally, modern identity verification solutions like ID-Pal can seamlessly integrate with existing customer management systems, streamlining the onboarding process.