Spot deepfakes, presentation attacks and synthetic identities and prevent fraud at source with a robust AI-powered identity verification solution.

Every day, AI fraud attempts are growing more sophisticated. Traditional identity verification solutions struggle to detect the latest threats, and manual checks add another layer of risk.

ID-Pal’s fraud prevention platform allows you to secure your onboarding channels and reduce the risk of fraud. Our identity verification solution uses a range of AI-powered technologies to accurately and quickly detect and prevent fraud.

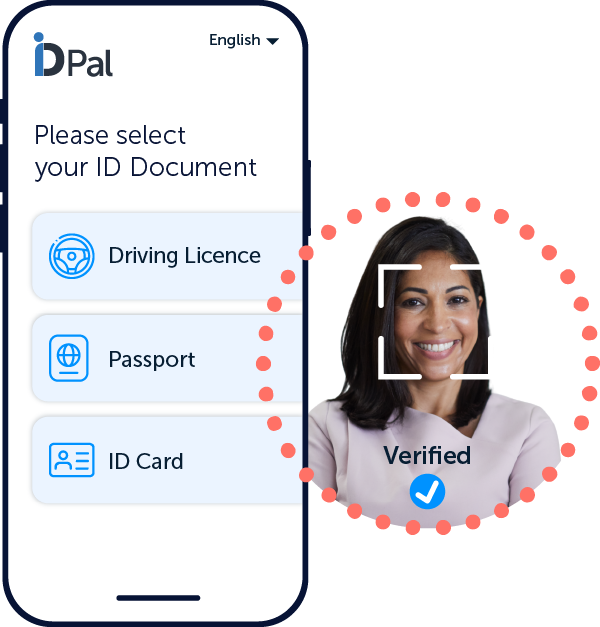

Our ID verification platform can onboard customers online, in-person or remotely in seconds and secure all your touchpoints from fraud.

Verify an identity and address data with confidence using the highest security standards and automate decisions on results.

Our ID verification checks for document verification, facial matching, liveness testing and address verification prevent fraud at source.

Enable robust fraud prevention across all onboarding touchpoints by integrating ID-Pal in just a day.

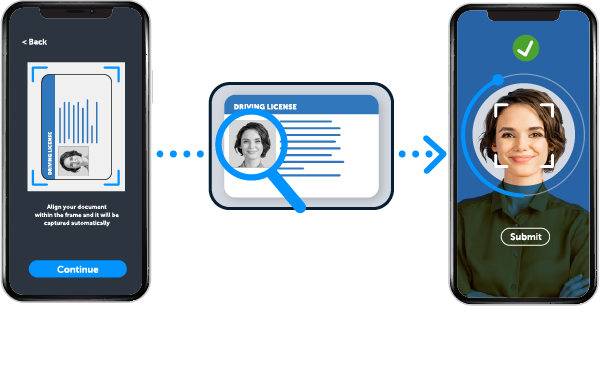

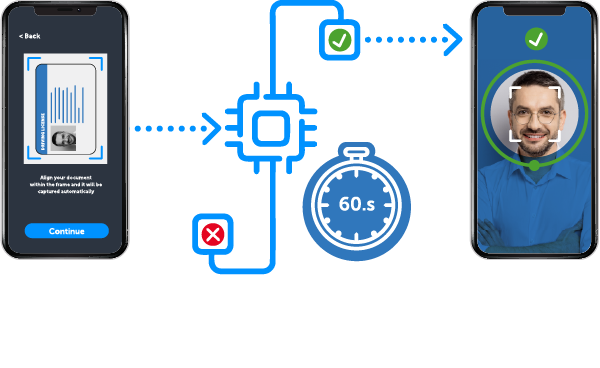

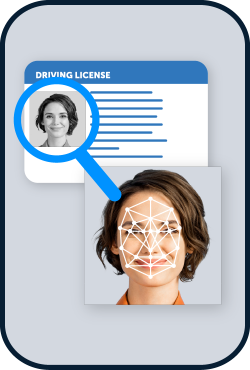

ID-Pal performs up to 70 technical checks per document, to ensure authenticity and confidently reject suspicious submissions. Our multi-layered identity verification process then verifies the facial image present.

Unburden your team from the challenge of manual identity verification. Our cutting-edge facial matching technology instantly confirms that the face in a submitted ID matches the person present. A 50-point biometric facial comparison maps features as part of our identity verification process.

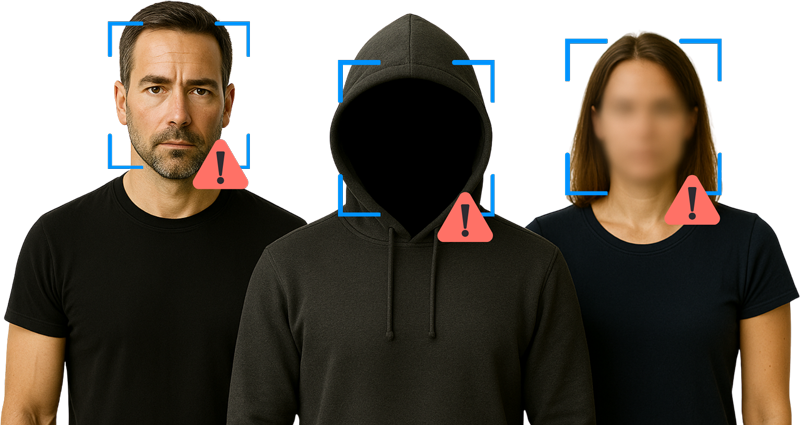

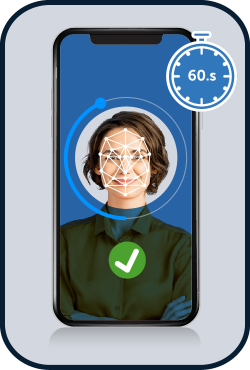

Liveness Checks confirm a real, live person is completing your identity verification process. ID-Pal liveness testing instantly assesses micro-variations in fraudulent techniques. This is why our liveness testing technology is independently certified to prevent the latest presentation attacks.

Reduce customer onboarding times with address e-verification. ID-Pal verifies an individual’s name and address against multiple databases during onboarding, ensuring one clear full address match & removing the need for proof of address.

Add an additional layer of fraud prevention to your plan. Screen individuals in real-time against global PEPs and sanctions lists. Perform adverse media checks across live sources and easily enroll individuals for periodic risk screening and ongoing monitoring.

Add-On Feature (additional cost)

Learn how our customers prevent fraud and simplify compliance

Have more questions? We’re here to help! Get in touch to find out more about our identity verification solutions.

100% AI-powered

Real-time verification

Zero access to customer data

Fraud prevention refers to the strategies, technologies, and processes designed to protect individuals and businesses from deceptive practices, theft, and other types of financial crimes. It is crucial because it safeguards not just financial assets but also personal information, brand reputation, and customer trust.

Implementing effective fraud prevention measures can significantly reduce the risk of financial losses, legal consequences, and reputational damage. For businesses, robust fraud prevention strategies are essential for maintaining operational integrity, ensuring regulatory compliance, and providing a secure environment for customers.

Identity verification plays a pivotal role in combating fraud by ensuring that individuals or entities engaging with your platform are who they claim to be. Our advanced identity verification process involves multiple checks, including document verification, biometric analysis, and live detection tests, to provide a robust defence against identity theft and impersonation attempts.

By verifying the authenticity of an individual’s identity documents and matching them with their biometric data, we significantly reduce the risk of fraudulent activities, offering peace of mind to both businesses and their customers.

The landscape of fraud prevention technology is rapidly evolving, with new trends constantly emerging to address the challenges of sophisticated fraud schemes.

Some of the latest trends include: