Simplify complex AML and due diligence processes into a single streamlined and efficient workflow, ensuring compliance with legislation in any jurisdiction.

Our online ID verification solutions are the easiest way for businesses to meet complex AML requirements. With compliance built in, organisations enjoy real-time verification of customers and businesses across the globe.

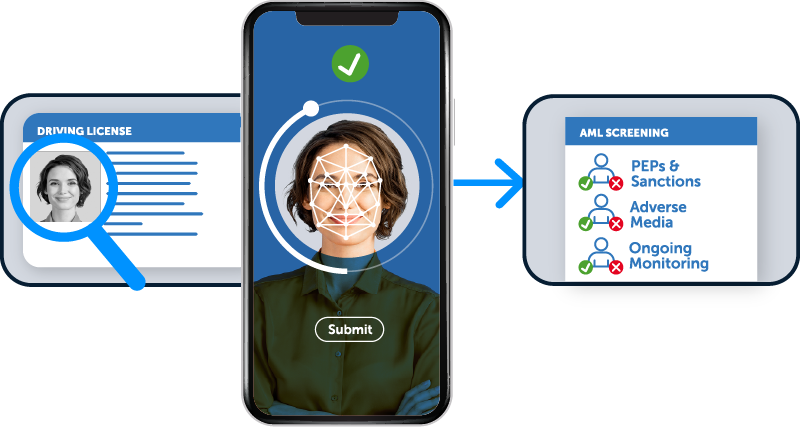

We ensure AML compliance with a combination of checks, including:

Combined with ongoing monitoring, full auditability and zero access to customer data, our approach is desgined to streamline and simplify even the most complex AML compliance requirements.

Verify the details submitted by an individual match their address. Gain confidence in the identity of your clients, members or customers.

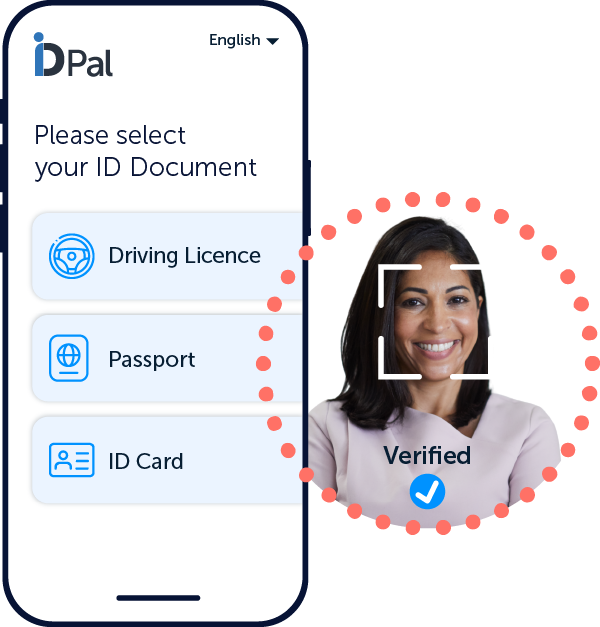

Covering 16,000+ identity documents from across 250+ jurisdictions, enjoy enhanced verification using 400+ trusted data sources.

A Client Due Diligence report is automatically generated per submission and securely stored, providing a full audit trail.

Stay compliant with relevant AML requirements in any jurisdiction and instantly adapt to regulatory changes.

Customise the solution to be compliant with AML per jurisdiction or profile. No lengthy deployment, toggle on/off requirements.

Apply a risk-based approach for identity verification and AML compliance. Instantly configure requirements according to customer type, channel and jurisdiction.

Fraudsters exploit weaknesses in compliance processes. Secure all channels and reduce the risk of fraud.

Using advanced matching algorithms, gain back resources diverted to address false-positive rates.

Learn how our customers prevent fraud and simplify AML compliance.

Have more questions? We’re here to help! Get in touch to find out more about our identity verification solutions.

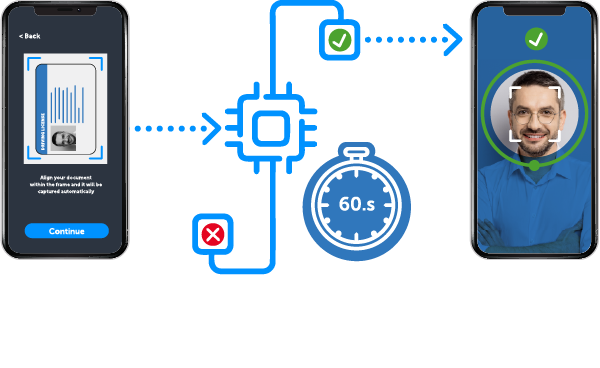

100% AI-powered

Real-time verification

Zero access to customer data

AML (Anti-Money Laundering) Compliance refers to the set of laws, regulations, and procedures designed to prevent individuals and entities from disguising illegally obtained funds as legitimate income. Essential for maintaining the integrity of the global financial system, AML compliance helps deter criminal activities by requiring financial institutions and other regulated entities to monitor customer behavior, conduct due diligence, and report suspicious activities.

For businesses, adhering to AML regulations is crucial not only for preventing financial crime but also for avoiding hefty penalties from non-compliance. It protects the reputation of institutions, enhances investor confidence, and ensures the stability and transparency of financial markets. Implementing robust AML measures allows organizations to detect and prevent money laundering and terrorism financing activities effectively, fostering a secure and trustworthy business environment.

An effective AML compliance program comprises several key components, designed to enforce compliance and mitigate risks:

Technology has significantly transformed anti-money laundering (AML) compliance by introducing sophisticated tools that automate and enhance the effectiveness of compliance processes.

Artificial Intelligence used in identity verification improves the efficiency and accuracy of fraud detection, allowing for the identification of fraudulent actors committing money laundering.

Identity verification platforms streamline AML compliance processes, offering dynamic risk assessment, efficient reporting tools, and automation of customer due diligence (CDD) reporting.

By leveraging these technologies, firms strengthen their AML compliance programs, ensuring more robust protection against financial crime while optimising operational efficiency.

AML requirements differ depending on jurisdiction, but generally apply to regulated entities in or adjacent to the finance sector. These include banks, payment institutions, electronic money institutions, cryptoasset service providers, gambling operators, professional services firms, and trust or company service providers.

Customer Due Diligence is the process of identifying and verifying a customer before establishing a business relationship. It involves confirming identity using reliable sources, understanding the purpose and expected nature of the relationship, and assessing the customer’s money laundering risk. CDD must be kept up to date and refreshed when risk factors or regulations change.

Enhanced Due Diligence (EDD) applies when a customer or transaction presents a higher risk of money laundering or terrorist financing. This includes politically exposed persons, customers linked to high-risk jurisdictions, complex ownership structures, or unusual activity.

Know Your Customer (KYC) is a subset of AML that focuses on identity verification at onboarding in order to confirm who they are. AML is broader and covers ongoing monitoring, risk management, reporting obligations, governance, and internal controls. Completing KYC checks alone does not satisfy full AML compliance requirements.